Psychologists Kahneman and Tversky have shown that people, even experienced researchers, make poor decisions when faced with uncertainty. In a research paper, Judgement Under Uncertainty, Kahneman and Tversky highlighted three decision making processes that people use to assess probabilities or make estimations

Your Money Mindset

About International Women’s Day

The theme of International Women’s Day 2020, explained

Big four banks pass on full RBA rate cut

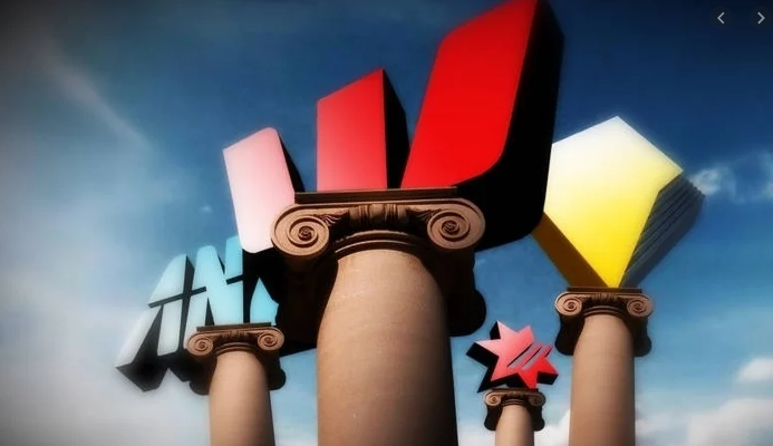

Bowing to pressure from the government, the “big four” banks have announced they will each pass on the Reserve Bank’s rate cut in full, saving borrowers hundreds of dollars a month. Westpac was the first out the door to hand the 0.25 percent rate cut over to customers on Tuesday, followed closely by Commonwealth Bank, NAB and then ANZ.

RBA marks new record low with March cash rate call

The Reserve Bank board has cut interest rates again by 0.25% at their March meeting, their fourth such cut since June last year. The move comes largely in response to the uncertainty caused by the global outbreak of the coronavirus (Covid-19), and up until about last Friday I’d have said it was a close call as to whether the bank would cut or stay put.

Having a good financial plan

How to give your superannuation a great start

How income from your investments is taxed

The increasing spread of Coronavirus – updated economic and investment market implications

My reasons for calm in the middle of a tough quarter

Coronavirus Update

Financial Advice: A brief overview of the Melbourne property market

Understanding investment risk and return

Family Trust Benefits, Explained

Three reasons why low inflation is good for shares and property

Share markets are at or around record levels despite lots of worries, particularly around the coronavirus (Covid-19) outbreak. A common concern is that this is because central banks (like the Fed and the RBA) are distorting market forces and just want higher asset prices. And flowing from this its argued that prices for assets like shares and property are overvalued, record highs are artificial, and a crash is inevitable.

Global tax group meets in Sydney over evasion

Be financially smart on Valentine’s Day

Plan ahead to make sure your wishes are carried out

From bushfires to Coronavirus – five ways to turn down the noise around investing

2020 has seen a very noisy start to the year with one major event with significant human and investment market implications after another. For Australia it started with an intensification of the bushfires but moved on to a significant ramping up of US/Iran tensions where, according to President Trump, war came “closer than you thought” and now the coronavirus outbreak is creating fears of a global pandemic and a big hit to global economic activity.