MoneySmart

(ASIC)

Understand investment risks

Investment risk is the likelihood that you’ll lose some or all the money you’ve invested. This can be due to your investment falling in value or not performing how you expected. All assets carry investment risks — some are riskier than others.

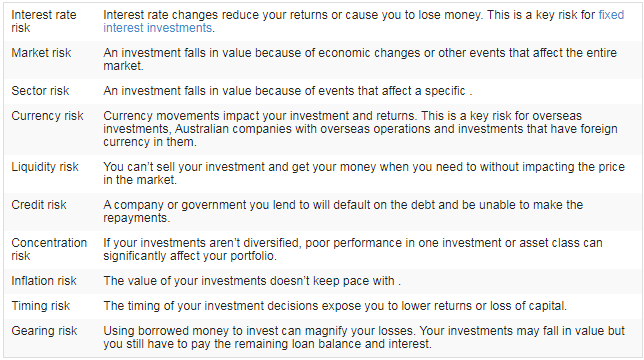

Risks that can affect the value of your investment include:

Risk and return

As a general rule, the higher the expected return on an investment, the higher the risk of the investment. The lower the expected return, the lower the risk. Lower risk means the returns are more stable and there is a lower chance you could lose money.

For example, a government bond is a low risk investment. It pays interest, and the value of the investment doesn’t change too much in the short term. Shares are a higher risk investment. The price of a share can move up and down a lot over a short amount of time.

The graph below shows the risk and return relationship for different asset classes.

There are no shortcuts to investing success. The combination of high returns and low risk doesn’t exist.

Know your risk tolerance

Your risk tolerance depends on your ability to cope with falls in the value of your investment. Your age, capacity to recover from financial loss, financial goals and your health are some of the factors that may influence your risk tolerance.

Ask yourself: how would I feel if I woke up tomorrow and found the value of my investments had dropped 20%?

If this drop would cause you to worry and withdraw your money, high risk investments are not for you.

Each investor’s risk tolerance is different and for different financial goals that have different investment time frames you may be willing to accept different levels of risk.

It’s important to understand your risk tolerance and find investments that are aligned to it.