January 20, 2021

Dr Shane Oliver

Head of Investment Strategy and Economics and Chief Economist

(AMP Capital)

Undoubtedly, the storming of the Capitol Building in Washington DC will go down as a dark mark in US history – not only due to the tragic loss of life which followed. The events of January 6 are a significant indication of social and political tensions in the country at the moment, stirred by President Trump’s dissatisfaction at his loss to Joe Biden in last year’s election.

So far, markets have been reasonably resilient in the face of this unrest. There was a point when the Capitol was stormed that markets appeared rattled, but this was brief and followed by decent gains once control was restored, suggesting markets weren’t too worried.

I think markets came to the view that the events of January 6 didn’t change the political trajectory in the US. Joe Biden will become President on January 20 and Vice President Mike Pence was able to confirm this, despite being evacuated from the Senate chamber hours earlier. Furthermore, Biden has a clearer road to get things done now, after securing a majority in the Senate.

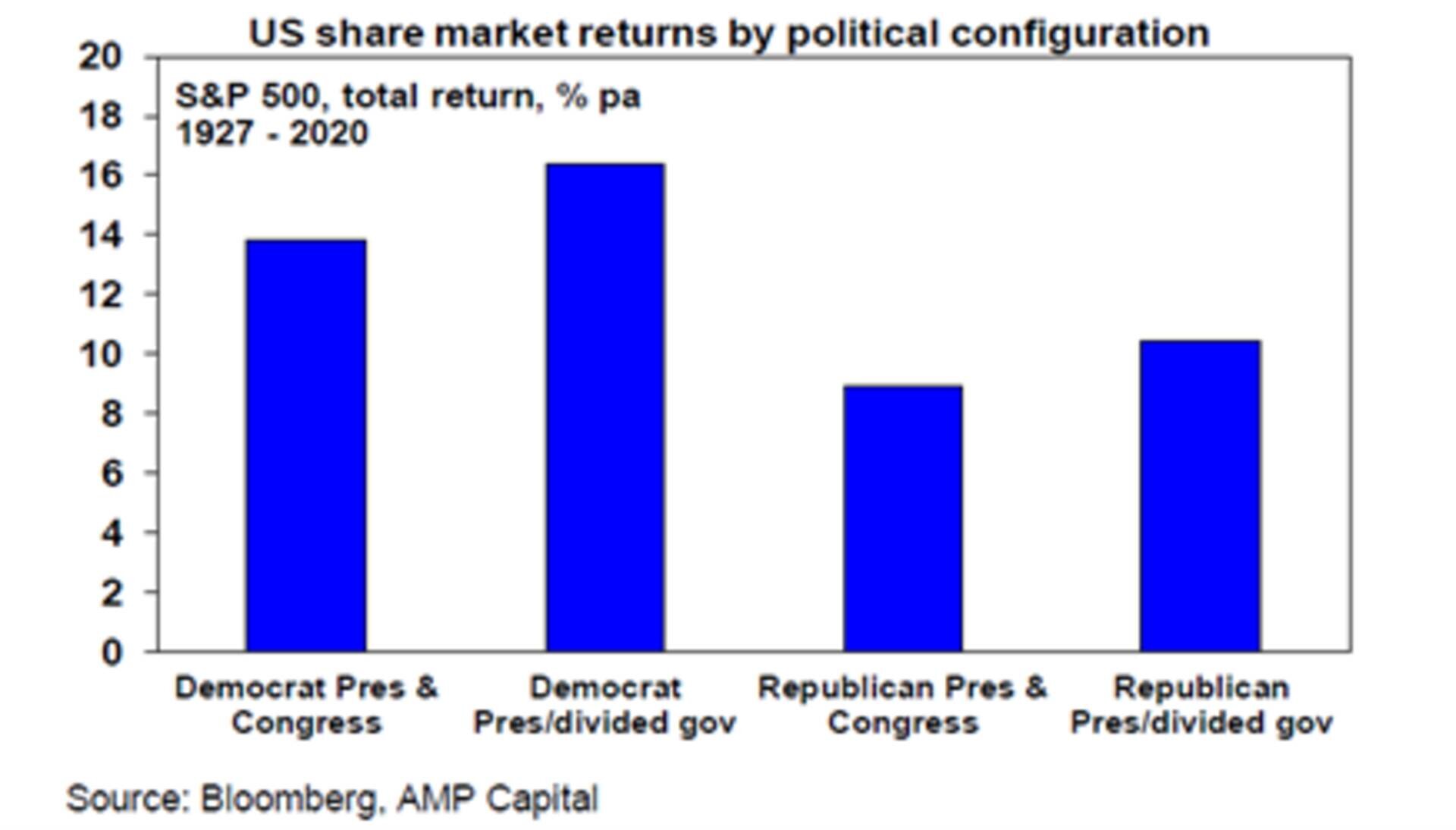

In fact, markets were already rallying on the outcome of the Georgia election which led to a Democratic majority after Vice President elect Kamala Harris’ vote was allowed for. Though it’s not quite the “blue wave” the Democrats were hoping for, it’s still a better outcome for Biden than no majority, and represents the second-best political scenario for share markets, if we use history as a guide (see chart below).

Whatever it is, the way you tell your story online can make all the difference.

Also, markets have grown accustomed to periods of unrest in the US. Just recently there was rioting and protesting in the streets for the Black Lives Matter movement, but as we noted at the time, markets were again relatively unaffected. Though the protesting was significant and did result in social disruption, it ultimately didn’t disrupt economic functioning on a broad scale.

Where there is potential for this level of unrest to impact markets is if they begin to impact consumer and business confidence and therefore economic activity. So far, that’s not the case, but it’s a possibility.

Though it seems optimistic right now, remember there is also the distinct possibility that the political situation will improve in the US. Biden looks likely to be more centrist in his behaviour, which will hopefully work towards easing tensions domestically and internationally for the US. He has certainly indicated his intention to heal divides which have flared up during the course of the Trump presidency and this likely will include economic policies aimed at helping the less well off.

All in all, it has been a tough and at times tragic period for the United States. But as I always say, especially at times of extreme uncertainty and bad news, it’s important to turn down the noise when it comes to investing and understand factors that typically do or don’t impact markets.

Whatever it is, the way you tell your story online can make all the difference.

Important notes

While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.