On 21 July 2020, the government announced its intention to extend the JobKeeper payment with some changes to the eligibility criteria and payment amounts. These changes do not impact JobKeeper payments until after 28 September 2020.

The JobKeeper payment extension is subject to the passage of law.

Find out about:

See also:

On 9 June 2020 the government announced that they will extend the enhanced instant asset write-off arrangements until 31 December 2020.

On 10 June 2020 the Minister for Housing and Assistant Treasurer announced that they will set the PAYG instalment GDP adjustment factor as 0% for the 2020–21 financial year. The Commissioner will adopt the same PAYG instalment adjustment factor for GST instalments over the same period which is in line with past administration practice

These measures are now law.

See also:

Announcement: Suspending indexation of tax instalmentsExternal Link

Treasury information – Economic response to coronavirusExternal Link

On 12 and 22 March 2020, the government announced measures to help the economy withstand and recover from the economic impact of COVID-19 (coronavirus). The following measures will be administered by the ATO and are now law.

JobKeeper Payment

Under the temporary JobKeeper Payment, businesses significantly impacted by the COVID-19 (novel coronavirus) outbreak will be able to access a subsidy from the government of $1,500 per fortnight per employee for up to 6 months. This will allow them to keep paying their employees.

JobKeeper Payment extension

The government has announced proposed changes to the JobKeeper payment program including:

an extension of the program to 28 March 2021

turnover tests to determine eligibility

tiered payments for eligible staff – from 28 September to 3 January 2021 and –from 4 January to 28 March 2021.

See also:

Eligibility

Employers

Employers (including not-for-profits) will be eligible for the subsidy if:

their business has a turnover of less than $1 billion and their turnover will be reduced by more than 30% compared to a similar period (of at least a month) last year

their business has a turnover of $1 billion or more and their turnover will be reduced by more than 50% compared to a similar period (of at least a month).

Businesses subject to the Major Bank LevyExternal Link are not eligible for the subsidy.

Employers will need to:

apply to us

provide supporting information demonstrating a downturn in their business

report the number of eligible employees employed by the business on a monthly basis.

Eligible employers will receive the payment for each eligible employee that:

was on their books on 1 March 2020

continues to be engaged by that employer.

Self-employed individuals

Self-employed individuals will be eligible to receive the JobKeeper Payment if their turnover has reduced (or is expected to reduce) by 30% compared to a similar period (of at least a month)

Self-employed individuals will need to:

apply to us

provide supporting information demonstrating a downturn in their business

Employees

Eligible employees include:

full-time, part-time or long-term casuals (with their employer on a regular basis for at least 12 months) as at 1 March 2020

stood down employees of eligible employers on 1 March 2020

stood down employees re-engaged by a business that was their employer on 1 March 2020

Where employees have multiple employers:

Only one employer will be eligible to receive the payment.

The employee will need to notify their primary employer to claim the JobKeeper Payment on their behalf.

The employee’s claiming of the tax-free threshold will, in most cases, be sufficient evidence that the employer is the employee’s primary employer. To be eligible, employees must be either an:

an Australian citizen

the holder of a permanent visa

a Protected Special Category Visa Holder

a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more

a Special Category (Subclass 444) Visa Holder.

If an employee has applied for support through Services Australia and the employer will be eligible for the JobKeeper Payment, the employee will need to advise Services Australia of their new income.

Payment process

The JobKeeper Payment will assist employers to continue operating by subsidising all or part of the employee’s income. We will make the payments to the employer on a monthly basis (in arrears).

Eligible employers will be paid $1,500 per fortnight per eligible employee.

Eligible employees will receive, at a minimum, $1,500 per fortnight, before tax. Employers are able to top-up the payment.

Employees will receive $1,500 per fortnight (before tax) if they were

employed on 1 March 2020

ceased employment with their employer due to the effects of COVID-19

re-engaged by the same eligible employer.

Where employers participate in the scheme, their employees will receive the payment as follows:

If an employee’s income is normally $1,500 or more per fortnight (before tax) they will continue to receive their regular income according to their usual workplace arrangements.

If an employee’s income is less than $1,500 per fortnight (before tax), their employer must pay their employee $1,500 per fortnight (before tax).

If an employee has been stood down, their employer must pay their employee $1,500 per fortnight (before tax).

It will be up to the employer to decide whether to pay superannuation on any additional wage paid because of the JobKeeper Payment.

Timing

The subsidy will apply from 30 March 2020.

Businesses can register their interest in participating in the scheme from 30 March 2020.

The first payments were received by employers in the first week of May.

Enhancing the instant asset write-off

The government has announced an extension of the current instant asset write-off (IAWO) arrangements until 31 December 2020. This extension will allow businesses more time to take advantage of the instant asset write-off enhancements. The extension is awaiting royal assent. The IAWO threshold has been increased from $30,000 to $150,000 and access has expanded to include businesses with aggregated annual turnover of less than $500 million (up from $50 million).

Timing

This measure will apply from 12 March 2020 until 31 December 2020, for new or second-hand assets first used, or installed ready for use in this timeframe.

Backing business incentive

The government is introducing a time limited 15-month investment incentive to support business investment and economic growth over the short-term, by accelerating depreciation deductions.

A deduction of 50% of the cost of an eligible asset on installation will apply, with existing depreciation rules applying to the balance of the asset’s cost.

See also:

For more information, visit Backing business investment – accelerated depreciation

Eligibility

Eligible businesses are businesses with aggregated turnover below $500 million.

Eligible assets are new assets that can be depreciated under Division 40 of the Income Tax Assessment Act 1997 (that is, plant, equipment and specified intangible assets, such as patents). This does not apply to second-hand Division 40 assets, or buildings and other capital works depreciable under Division 43.

Timing

This applies to assets acquired after announcement and first used or installed by 30 June 2021.

Boosting cash flow for employers

As announced on 22 March, the government is providing up to $100,000 to eligible small and medium sized businesses and not-for-profits (including charities) that employ people, with a minimum payment of $20,000. These payments will help business and not-for-profit cash flow so they can keep operating, pay their bills and retain staff.

Small and medium sized business entities with aggregated annual turnover under $50 million and that employ workers are eligible. Not-for-profit entities (NFPs), including charities, with aggregated annual turnover under $50 million and that employ workers will now also be eligible. This will support employment activities at a time where NFPs are facing increasing demand for services.

Under the enhanced scheme, employers will receive a payment equal to 100% of their salary and wages withheld (up from 50%), with a:

minimum payment of $10,000

maximum payment of $50,000.

An additional payment is also being introduced in the July – October 2020 period. Eligible entities will receive an additional payment equal to the total of all the Boosting Cash Flow for Employers payments they have received. This means that eligible entities will receive at least $20,000, up to a total of $100,000 under both payments. This additional payment continues cash flow support over a longer period:

increasing confidence

helping employers to retain staff

helping entities to keep operating.

The cash flow boost provides a tax-free payment to employers. We will automatically calculate it.

Eligibility for Boosting Cash Flow for Employers payments

Small and medium sized business entities and NFPs with aggregated annual turnover under $50 million and that employ workers will be eligible. Eligibility will generally be based on prior year turnover.

We will deliver the payment as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements.

Eligible employers that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 100% of the amount withheld, up to a maximum payment of $50,000.

Eligible employers that pay salary and wages will receive a minimum payment of $10,000, even if they are not required to withhold tax.

The payments will only be available to active eligible employers established before 12 March 2020. However, charities that are registered with the Australian Charities and Not-for-profits Commission will be eligible regardless of when they were registered, subject to meeting other eligibility requirements. This recognises that new charities may be established in response to COVID-19.

Eligibility for additional payment

To qualify for the additional payment, the entity must continue to be active.

Monthly activity statement lodgers

For monthly activity statement lodgers, the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020, July 2020, August 2020 and September 2020 activity statements (up to a total of $50,000).

Quarterly activity statement lodgers

For quarterly activity statement lodgers the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to half of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020 and September 2020 activity statements (up to a total of $50,000).

Timing of Boosting Cash Flow for Employers payments

The Boosting Cash Flow for Employers payment will be applied to a limited number of activity statement lodgments. We will deliver the payment as a credit to the entity upon lodgment of their activity statements. If this places the entity in a refund position, we will deliver the refund within 14 days.

Quarterly lodgers will be eligible to receive the first payments for the quarters ending March 2020 and June 2020.

Monthly lodgers will be eligible to receive the first payments for the March 2020, April 2020, May 2020 and June 2020 lodgments. To provide a similar treatment to quarterly lodgers, the payment for monthly lodgers will be calculated at three times the rate (300%) in the March 2020 activity statement.

The minimum payment will be applied to the entities’ first lodgment.

Timing of additional payment

The additional payment will be applied to a limited number of activity statement lodgments. We will deliver the payment as a credit to the entity upon lodgment of their activity statements. If this places the entity in a refund position, we will deliver the refund within 14 days.

Quarterly lodgers will be eligible to receive the additional payment for the quarters ending June 2020 and September 2020. Each additional payment will be equal to half of their total initial Boosting Cash Flow for Employers payment (up to a total of $50,000).

Monthly lodgers will be eligible to receive the additional payment for the June 2020, July 2020, August 2020 and September 2020 lodgments. Each additional payment will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment (up to a total of $50,000).

Temporary early release of superannuation

Individuals adversely financially affected by COVID-19 may be able to access some of their superannuation early. On 23 July 2020, the government announced they will extend the application period for 2020-21 year to 31 December 2020. Eligible citizens and permanent residents of Australian and New Zealand can apply once online through myGov to access up to $10,000 of their superannuation in the 2019–20 financial year.

Applications for the 2019–20 financial year closed on 30 June 2020.

Temporary residents are not eligible to apply in the 2020–21 financial year.

You will not need to pay tax on amounts released under COVID-19 early release of super and will not need to include these amounts in your tax return – amounts released under other compassionate grounds must be included.

Accessing your super early:

will affect your super balance

may affect your future retirement income.

You should consider seeking financial advice before applying for early release of super. Services Australia’s Financial Information ServiceExternal Link can provide free, confidential financial information.

Eligibility and Timing

Applications can be submitted online through myGov between 1 July 2020 and 31 December – applications close at 11:59pm Australian Eastern Standard Time (AEST) on 31 December 2020.

It is important that you assess your eligibility accurately and honestly.

More information

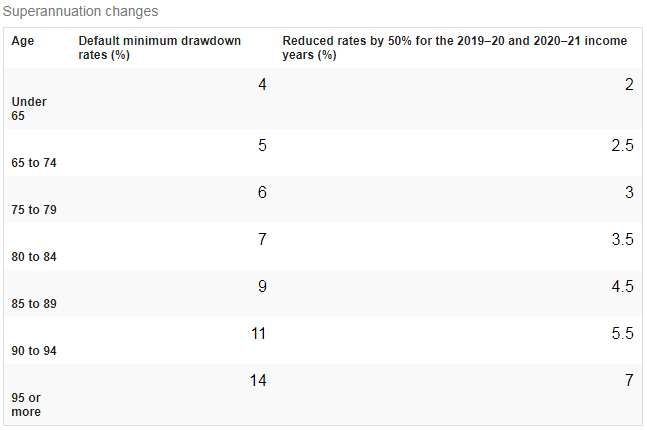

Temporarily reducing superannuation minimum drawdown rates

The government is temporarily reducing superannuation minimum drawdown requirements for account-based pensions and similar products by 50% for 2019–20 and 2020–21. This measure will benefit retirees holding these products by reducing the need to sell investment assets to fund minimum drawdown requirements.

The government is also reducing both the upper and lower social security deeming rates by a further 0.25 percentage points in addition to the 0.5 percentage point reduction to both rates announced on 12 March 2020.

More information

For more information on the Australian Government’s economic response to coronavirus, visit treasury.gov.au/coronavirusExternal Link.

Businesses can visit business.gov.auExternal Link to find out more about how the economic response complements the range of support available to small and medium businesses.

Last modified: 29 Jul 2020