Investment markets and key developments – Weekly market update 27/10

Most global share markets fell again over the last week on the back of ongoing worries about high bond yields, the war in Israel and some mixed US earnings results. For the week US shares fell 2.5%, Eurozone shares fell 0.3% and Japanese shares lost 0.9%. However, Chinese shares rose 1.5% helped by the announcement of policy stimulus. The poor global lead along with increased expectations for another rate rise following hawkish RBA comments and higher than expected inflation data saw the Australian share market fall another 1.1% for the week taking it back to levels last seen a year ago with falls led by property, IT and energy shares. 10-year bond yields pulled back a bit in the US and Europe but rose further in Japan and Australia. Oil prices fell, despite a rise later in the week on the back of reports of expanding Israeli military activity in Gaza. Metal and iron ore prices rose with the gold price rising back above $US2000 for the fourth time in the last few years. The $A rose slightly, despite a rise in the $US.

From their July highs US and global shares have now fallen 10% and Australian shares have fallen just over 8%, but the risk of further weakness remains high. The ongoing rising trend in bond yields is still ramping up the pressure on share market valuations which are already stretched; central banks are continuing to signal high for longer interest rates with some like the RBA looking like they will hike more; the risk of recession remains high; the risk of an escalation to involve Iran in the Israeli conflict which would directly threaten oil supplies remains high; this would add to inflation and recession fears; and uncertainty remains high around the China’s economy and property markets. So, the ride for shares is likely to remain volatile in the near term.

But several things should help shares by year end: seasonality will become positive in the next two months; inflation is likely to continue to fall which should take pressure off central banks allowing them to starting easing next year; and any recession is likely to be mild. So, while near term uncertainties remain high our 12-month view on shares remains positive.

Both the ECB and the Bank of Canada left rates on hold and look to have peaked, but neither are close to rate cuts. The ECB sounded less hawkish adding to confidence it has peaked, but again referred to maintaining interest rates at high levels for a “sufficiently long duration”, there was no pushback against the rise in bond yields and President Lagarde said its too early to consider cuts. The BoC expressed concern that “progress towards price stability is slow and inflationary risks have increased.”

And in Australia another rate hike is now looking likely after September quarter inflation came in higher than expected at 5.4%yoy. The good news is that inflation is falling, down from 6% in the June quarter and 7.8% in the December quarter. This is consistent with the global trend and we are continuing to see slowing inflation in food, clothing, new dwelling purchase costs and household equipment & furnishings helped by slowing goods price inflation. Holiday travel inflation also continues to slow.

Source: ABS, AMP

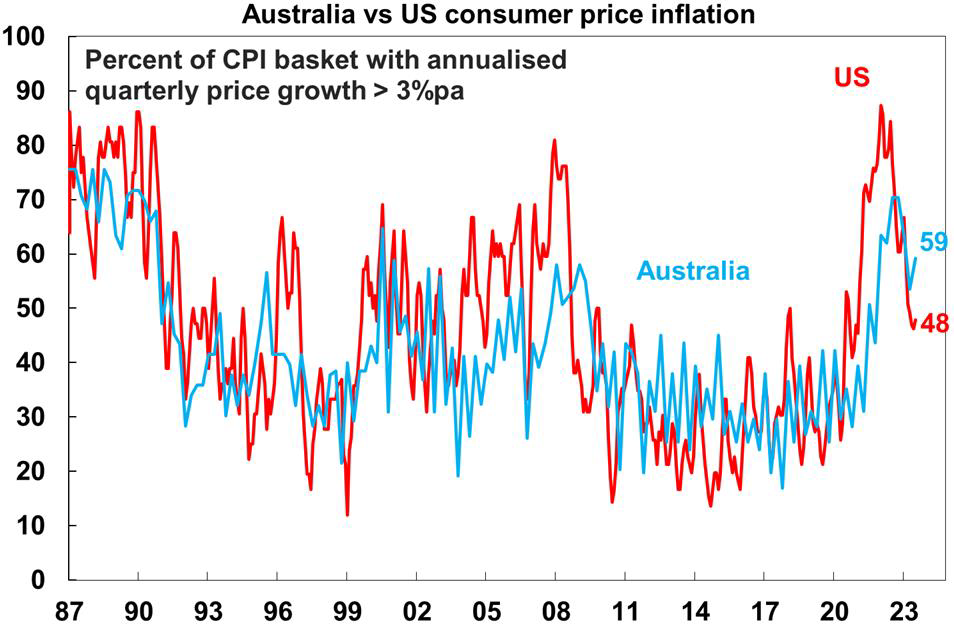

…but the bad news is that inflation fell less than expected and particularly less than the RBA had been expecting. The trimmed mean underlying measure only slowed to 5.2%yoy which is significantly above the RBA’s forecast in August that it would slow to around 4.8%yoy (as implied by a graph in its Statement on Monetary Policy). And beyond the 7.2% surge in petrol prices and the 4.2% rise in electricity prices, services inflation remains sticky evident in strong increases in rents, meals & takeaway, vet services, hairdressing and insurance. The breadth of price increases also increased slightly with a rise to 59% of components seeing a more than 3% annualised price rise.

Source: Bloomberg, AMP

Our Pipeline Inflation Indicator still points down for Australia, so its likely that the pickup in quarterly underlying inflation seen last quarter will be an aberration and the downswing will resume particularly next year as household spending continues to weaken.

Source: Bloomberg, AMP

But the smaller than expected fall in underlying inflation last quarter taken together with recent hawkish commentary from the RBA suggests another rate hike is now looking likely at the RBA’s November board meeting. The RBA is concerned that if inflation stays above its target band for longer than its already forecasting then it will boost long term inflation expectations making it even harder to get inflation back to target. As such the minutes from its last meeting noted that it has a “low tolerance” for a slower fall in inflation than expected and Governor Bullock noted the RBA “will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation”. She didn’t give much away at the Senate Economics Committee after the CPI release, noting that “the RBA will now have to think about what [the higher than forecast September quarter CPI] means for RBA forecasts and whether that’s material or not”. However, there is a high likelihood that it will conclude that the 0.4% higher than expected rise in underlying inflation last quarter was material, particularly with further evidence of sticky services inflation, and so will raise rates again. So, while we think it’s close call – as inflation is still falling and household stresses are now significant – on balance we think the RBA will hike again and are now allowing for a 0.25% hike in November taking the cash rate to 4.35%. The money market has priced in a 51% chance of a rate hike in November (which is up from 22% a week ago) and 100% chance of a hike by February. Given the RBA’s past track record of undertaking rate moves on Melbourne Cup Day along with the slower than expected fall in inflation it would be dangerous to bet against a move.

Unfortunately, the Treasurer’s comment that the inflation data was not a “material change” to the inflation outlook ahead of the RBA formally reviewing whether it was or not adds to pressure on the RBA to hike again or otherwise risk raising questions about its independence.

However, while we now expect the RBA to hike again based on its recent comments and the higher-than-expected inflation data and we understand the need to keep long term inflation expectations down, our own view is that it should give more time for the lags with which rate hikes impact the economy to play out and so should remain in wait and see mode for longer. This is particularly so given increasing signs of faltering household spending, 1 in 7 households already being cashflow negative based on RBA analysis, inflation still falling and likely on our Indicator to fall further and increasing uncertainty globally. Continuing to raise rates will further ratchet up the already high risk of recession next year.

The Monkees were a manufactured pop group like The Spice Girls, with their TV show inspired by the Beatles film A Hard Day’s Night. Despite this, or maybe thanks to it, they put out some nice material one of which was a song called Shades of Gray (written by Brill Building songwriters Barry Mann and Cynthia Weil) about how when they and the world were young life seemed simple and it was easy to tell right from wrong and black from white but now its all complicated with “only shades of gray” (I’ll stick with the US spelling as in the song). On one level it refers to the social upheaval of the sixties but on another it relates to growing up and realising that many issues are just shades of gray which is how I interpreted it on first hearing it long after the 1960s. Interestingly gray is the colour of compromise between the extremes of black and white. Its not exactly bright enough for me but it seems to me the world would be a more tolerant and respectful place if we all recognised that so many issues are not black and white but shades of gray. Studying economics is a good place to start!

Economic activity trackers

Our Economic Activity Trackers are still not showing anything decisive in terms of the direction of economic activity.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMP

Major global economic events and implications

October business conditions PMIs (which are global surveys of businesses) were mixed across major countries – with Europe, Japan and Australia down but the US and UK up – but they remain weak. The good news is that pricing pressures are continuing to ease with falls in input and output prices and order backlogs remaining down.

Source: Bloomberg, AMP

Strong US GDP growth unlikely to move the Fed to hike again. September quarter GDP rose a strong 4.9% at an annualised rate, helped by strong growth in consumer spending, government spending and inventory accumulation. While this was stronger than expected and risks a resurgence in the US labour market if sustained, its unlikely to dissuade the Fed from leaving rates on hold at its November meeting. The strength in consumer spending is unlikely to be sustained with the saving rate now well below normal levels, business investment was flat, housing investment fell slightly, the contribution from inventories augurs poorly for subsequent quarters and inflation continued to fall. In particular, core private final consumption inflation fell to 3.7%yoy in September from 3.8%. In other data, new home sales rose strongly and remains in an uptrend but a continuing plunge in mortgage applications for home purchase and in home builder conditions point to renewed weakness ahead. Capital goods orders were solid and jobless claims rose but remain low.

Source: Bloomberg, AMP

Nearly 50% of US S&P 500 companies have now reported September quarter earnings with 79% coming in better than expected, which is above the norm of 76%. So far earnings growth for the quarter has improved to +2.8%yoy.

Source: Bloomberg, AMP

The election of Mike Johnson (an evangelical conservative lawyer and Trump supporter) as Speaker of the US House of Representatives has reduced the risk of a shutdown in November (as he plans a continuing funding resolution out to either January or April) and increases prospects for aid to Israel but puts at risk funding for Ukraine, will increase pressure for government spending cutbacks next year and increases political polarisation in Congress.

Eurozone consumer confidence fell in October, private lending fell 0.2% over the year to September with the ECB’s latest bank lending survey showing that tight monetary policy is driving tight lending standards and weak loan demand.

Source: Macrobond, AMP

Higher inflation in Japan may spur the BoJ to move again. Inflation in Tokyo in October rose unexpectedly to 3.3%yoy, from 2.8% with core inflation also rising to 2.7% from 2.4%. This appears to reflect reduced subsidies but may influence the BoJ adding to the risk of a further relaxation of its yield curve control in the week ahead.

China announced fiscal stimulus. Consistent with reports a few weeks ago China formally announced the issuance of 1 trillion Renminbi (or $A215bn) in new bond issuance to finance spending on infrastructure projects mainly around water conservancy and rebuilding in areas hit by floods. This reportedly will take the budget deficit to 3.8% of GDP from 3%. This clearly indicates that the Government is committed to reaching its 5% growth target although it won’t provide a panacea for China’s structural problem including in the property sector.

Australian economic events and implications

Australian business conditions PMIs for October weakened again with stable input prices at a still high level, but falling output prices and work backlogs.

Source: Bloomberg, AMP

Consistent with the stickiness in input prices, producer price inflation accelerated to 1.8%qoq in the September quarter driven by surging prices for petroleum and electricity and gas. As a result this was well up from a 0.5%qoq rise in the June quarter so underlying annual producer price inflation only slowed to 3.8%yoy from 3.9%. So as with CPI inflation, annual producer price inflation is trending down, but remains too high. Australia’s terms of trade also fell further in the September quarter with a solid gain in import prices but falling export prices. This will weigh on national income.

Source: Macrobond, AMP

Monthly permanent and long-term arrivals data suggests that the surge in net immigration is continuing beyond the likely 500,000 level seen in the last financial year. This was way above the 180,000 forecast in the March budget last year and its hard to see how its going to fall back to the 315,000 this financial year that was forecast in the May budget. With home building constrained this will only add to the already big housing shortage.

Source: ABS, AMP

What to watch over the next week?

In the US, the Fed (Wednesday) is expected to leave the Fed Funds rate at 5.25-5.5% helped by the downtrend in core inflation which is now allowing it to proceed carefully. However, because growth is stronger than expected its likely to retain a mild hawkish bias and reiterate that rates will stay high for longer. On the data front, October jobs data (Friday) is expected to show a slowing in non-farm payroll growth to 170,000, unemployment unchanged at 3.8% and wages growth slowing to 4.0%yoy. In other data, expect a further slowing in growth in the Employment Cost Index for the September quarter to 4.4%yoy (Tuesday), further weakness in consumer confidence and still solid home price growth (also Tuesday), the October ISM indexes to show still weak manufacturing conditions (Wednesday) and a slight fall in services (Friday) and job openings (also Wednesday) are likely to resume their downswing.

September quarter Eurozone GDP growth (Tuesday) is likely to be zero in the quarter and just 0.2%yoy, with October CPI inflation (also Tuesday) slowing to 3.1%yoy. Unemployment in September (Friday) is expected to have remained at 6.4%.

The Bank of England (Thursday) is expected to remain on hold at 5.25% but retain a tightening bias.

The Bank of Japan (Tuesday) is not expected to change its policy rate at -0.1% but may further relax its yield curve control and revise up its near-term growth and inflation forecasts. Jobs and retail sales data to be released Tuesday) is expected to remain solid but with industrial production remaining soft.

Chinese business conditions for October due on (Tuesday and Wednesday) are likely to remain relatively subdued.

In Australia, expect September retail sales growth (Monday) of just 0.1% with September quarter real retail sales (Friday) falling by 0.8%qoq, September housing credit growth to remain subdued (Tuesday), September building approvals to fall 2%mom but CoreLogic home price data for October to show another 0.9% gain (both Tuesday), September housing finance to rise 0.7% and the trade balance to rise to around $11.5bn (both Thursday).

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of high for longer rates from central banks, rising bond yields which have led to poor valuations and the uncertainty around the war in Israel.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” continues to hit space demand as leases expire.

With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year as the RBA starts to cut rates. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of a less hawkish RBA and global uncertainties, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Dr Shane Oliver

Head of Investment Strategy and Economics and Chief Economist

AMP Investments

27 Oct 2023

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.