To calculate a capital gain or loss, you need to know the assets:

cost base to calculate a capital gain

reduced cost base to calculate a capital loss.

The basic rules are the same for all assets, but for real estate there are some additional rules for:

Costs of owning

When working out the reduced cost base for real estate you do not include:

council rates

insurance

land tax

maintenance costs

interest on money you borrowed to buy or improve the property.

You include these in the cost base only if:

you acquired the property under a contract entered into after 20 August 1991 (or, if you didn’t acquire it under a contract, you became the owner after that date), and

you couldn’t claim a deduction for the costs because you didn’t use the property to produce assessable income – for example, it was vacant land, your main residence or a holiday house during the period.

Example: Block of land cost base

On 1 July 2015, Kris bought a block of land for $240,000 (including legal fees, stamp duty and related expenses). He sold it on 30 June 2020. During the five years he owned the block, he paid $25,000 for rates, land tax and interest.

As he did not use the land to generate any income, he could not claim a deduction for any of these expenses.

The cost base of the block of land is $265,000.

End of example

Cost base adjustments for capital works deductions

In working out the cost base or reduced cost base for a property that you’ve used to produce assessable income, such as a rental property or business premises, you may need to exclude any capital works deductions you’ve claimed in any income year (or omitted to claim but can still claim because the period for amending the relevant income tax assessment has not expired).

You exclude the amount of these capital works deductions from:

the reduced cost base of the asset

the cost base of the asset (including a building, structure or other capital improvement that is treated as a separate asset for CGT purposes) if:

you acquired the asset after 7:30pm (by legal time in the ACT) on 13 May 1997, or

you acquired the asset before that time and the expenditure that gave rise to the capital works deductions was incurred after 30 June 1999.

However, if you omitted to claim capital works deductions because you didn’t have sufficient information to determine the amount and nature of the construction expenditure, you don’t need to exclude the amount of such deductions from the cost base or reduced cost base of the CGT asset.

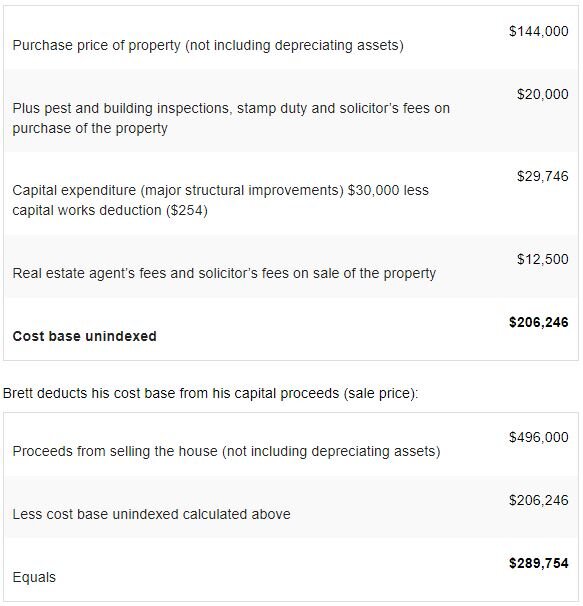

Example: Sale of a rental property

Brett purchased a residential rental property on 1 July 1998. He paid $150,000 for the property, of which $6,000 was attributable to depreciating assets. He also paid $20,000 in total for pest and building inspections, stamp duty and solicitor’s fees.

In the next few years, Brett incurred the following expenses on the property:

Brett can’t include the expenses of $33,000 in the cost base as he was able to claim deductions for them.

Brett decided to sell the property, and a real estate agent advised him that if he spent around $30,000 on major structural repairs, the property would be valued at around $500,000. The major structural improvements were completed on 1 October 2019 at a cost of $30,000.

On 1 February 2020, he sold the property for $500,000 (of which $4,000 was attributable to depreciating assets).

Brett’s real estate agent’s fees and solicitor’s fees for the sale of the property totalled $12,500.

Brett can claim a capital works deduction of $254 ($30,000 × 2.5% × 124 ÷ 366) for the major structural improvements.

This is Brett’s only capital gain for the year and he has no capital losses to offset from this year or previous years.

Brett works out his cost base as follows:

He decides the discount method will give him the best result, so he uses this method to calculate his capital gain:

$289,754 × 50% = $144,877

Brett shows $144,877 at Net capital gain on his tax return (supplementary section).

Brett shows $289,754 at Total current year capital gains on his tax return (supplementary section). Brett must also make balancing adjustment calculations for his depreciating assets. Because he used the property 100% for taxable purposes he will not make a capital gain or capital loss from the depreciating assets.

End of example

See also: