With the initial phase of the JobKeeper program due to conclude on 27 September 2020, yesterday the Government announced a second phase which will extend the program for an additional six months through to 28 March 2021. The MFAA welcomes this announcement and the extension of this important economic support measure.

The second phase has a lower two-tier payment structure and a requirement to retest employer eligibility.

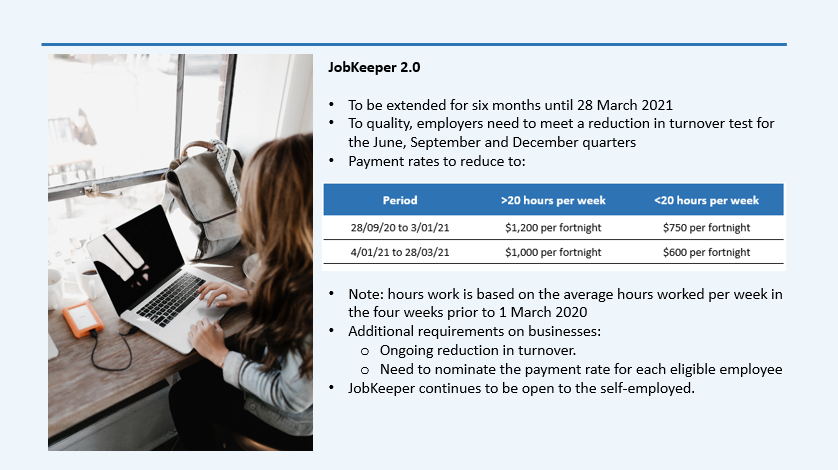

In brief, a summary of the announced changes is provided below.

New Payment rate

From 28 September 2020 to 3 January 2021, the JobKeeper Payment rates will be:

$1,200 per fortnight for all eligible employees who, in the four weeks of pay periods before 1 March 2020, were working in the business or not-for-profit for 20 hours or more a week on average, and for eligible business participants who were actively engaged in the business for 20 hours or more per week on average in the month of February 2020; and

$750 per fortnight for other eligible employees and business participants.

From 4 January 2021 to 28 March 2021, the JobKeeper Payment rates will be:

$1,000 per fortnight for all eligible employees who, in the four weeks of pay periods before 1 March 2020, were working in the business or not-for-profit for 20 hours or more a week on average and for business participants who were actively engaged in the business for 20 hours or more per week on average in the month of February 2020; and

$650 per fortnight for other eligible employees and business participants

Employer eligibility requirements - a need to retest turnover

For the first JobKeeper Payment extension period of 28 September 2020 to 3 January 2021 - employers will need to demonstrate that their actual GST turnover has significantly fallen (using the same 30%, 50% or 15% declines as currently applicable) in both the June quarter 2020 (April, May and June) and the September quarter 2020 (July, August September) relative to comparable periods (generally the corresponding quarters in 2019).

For the second JobKeeper Payment extension period of 4 January 2021 to 28 March 2021, employers will again need to demonstrate that their actual GST turnover has significantly fallen in each of the June, September and December 2020 quarters relative to comparable periods (generally the corresponding quarters in 2019).

All other employer eligibility conditions remain unchanged.

The eligibility rules for employees also remain unchanged.

Further details are likely to be released in the coming days and can be viewed at:

https://treasury.gov.au/coronavirus/jobkeeper/extension or