MoneySmart

(ASIC)

When a person dies, their super balance is usually paid to their nominated beneficiary. This is called a ‘super death benefit’. Superannuation benefits are typically made up of two components: tax-free and taxable (which may come from a taxed or untaxed source).

The tax-free component includes:

After-tax contributions

Government co-contributions.

The taxable (taxed) component consists of:

Employer contributions

Salary sacrificed contributions

Personal contributions where a tax deduction was claimed.

The taxable (untaxed) component only applies to super from an untaxed source, such as a public sector defined benefit super fund for government employees.

Super death benefits tax

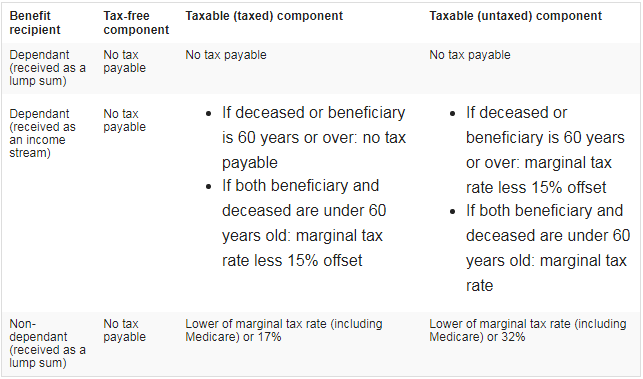

The amount of tax a beneficiary pays is determined by:

The super component

Whether they are a dependant for tax purposes

Whether the super is taken as a lump sum or an income stream (non-dependants can only receive a super death benefit as a lump sum).

Tax treatment for each super component of a death benefit