This report quantifies the value an adviser provides throughout a client’s investing journey. The Value of an Adviser formula offers a memorable and repeatable framework for advisers to have that conversation with confidence.

Executive summary

At Russell Investments, we are adviser-centric. We recognise the difference a great adviser can make to their clients’ lives and are committed to helping advisers reach their business goals.

This annual report looks holistically at the real value advisers deliver for their clients—from the knowledge and expertise required to help clients build personalised portfolios, to the support they provide when market conditions change, and the range of additional wealth management services they offer, such as tax and estate planning.

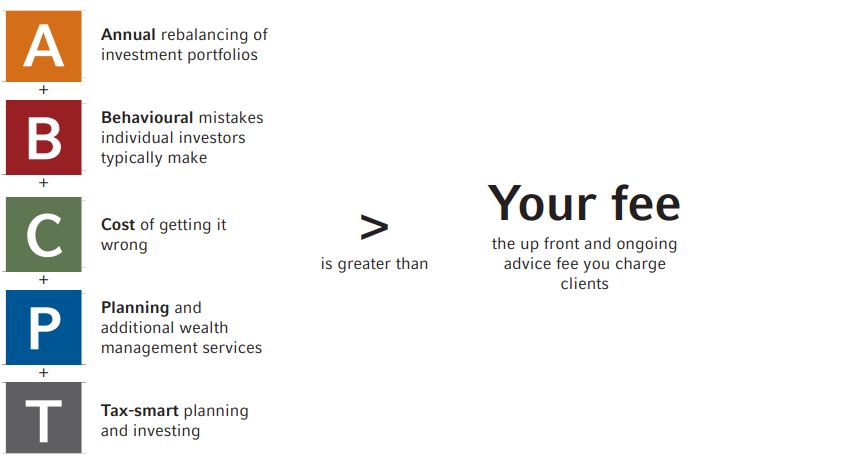

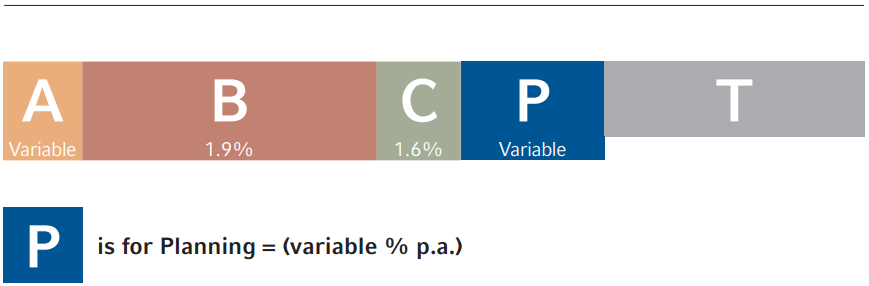

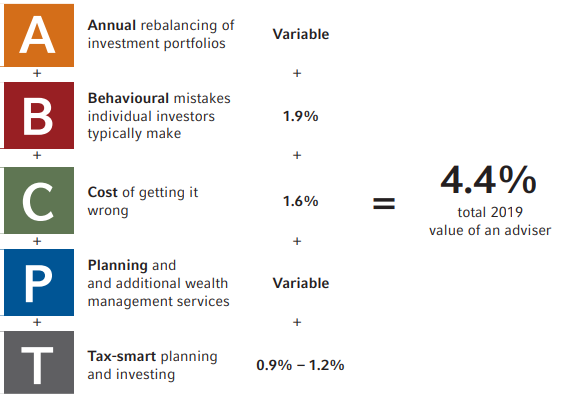

In this 2019 report, we have examined the various components of an adviser’s value proposition and estimated that advisers deliver value of at least 4.4% or more every year to their clients beyond investment-only advice. By demonstrating to clients how this value exceeds the fee charged, advisers can improve client engagement and satisfaction in a time of continued focus on advisory fees and natural customer skepticism about delivered value.

For the majority of advice businesses, clients are their most persuasive advocates, so articulating the tangible benefits of advice to clients is essential. By looking at the full value equation of an adviser’s services—annual rebalancing, preventing behavioral mistakes, planning and additional wealth management services, and tax-smart investing—advisers can clearly demonstrate the value they deliver.

Introduction

Following a number of regulatory reviews, fees and trust are top-of-mind for many investors, and for advisers it can be difficult to explain what goes on behind the scenes to prepare, deliver and implement advice. This report is designed to make that easier for advisers.

The ABCs of adviser value

The role of an adviser in co-ordinating a client’s wealth management needs by assisting with the accumulation, distribution and transfer of wealth can be complex. And this complexity becomes even more apparent as markets move into a time of potentially lower returns and higher volatility.

This report is therefore designed to quantify not just the technical expertise an adviser provides, but also the emotional support and guidance an adviser offers throughout a client’s investing journey.

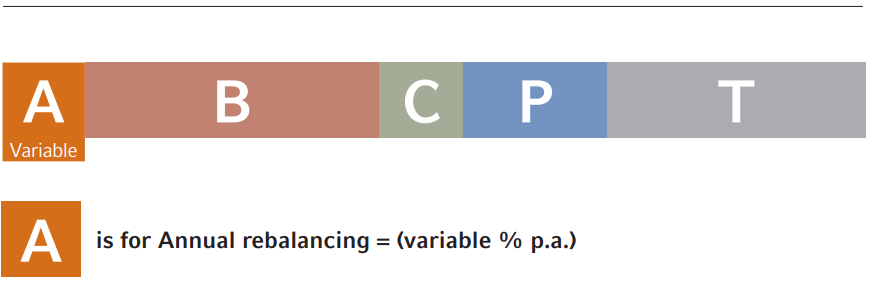

It can be easy to underestimate the importance of disciplined rebalancing and avoiding unnecessary risk exposure when investing. When a certain asset class is performing strongly, it can be tempting to hold an overweight position in that asset class. This can have negative repercussions if markets correct and investors find themselves with too much invested in a volatile asset class.

As this chart demonstrates, a hypothetical balanced index portfolio that has not been rebalanced would look more like a growth portfolio and expose the investor to risks they didn’t agree to.

Knowing when and why to rebalance is key and this comes down to a sound client/adviser relationship. An adviser with a deep understanding of their clients’ goals and risk tolerance is best placed to know how often rebalancing should occur and what adjustments best align to current lifestyle goals.

The potential percentage result of a rebalanced vs un-rebalanced portfolio can vary depending on the individual clients’ investment strategy and circumstances.

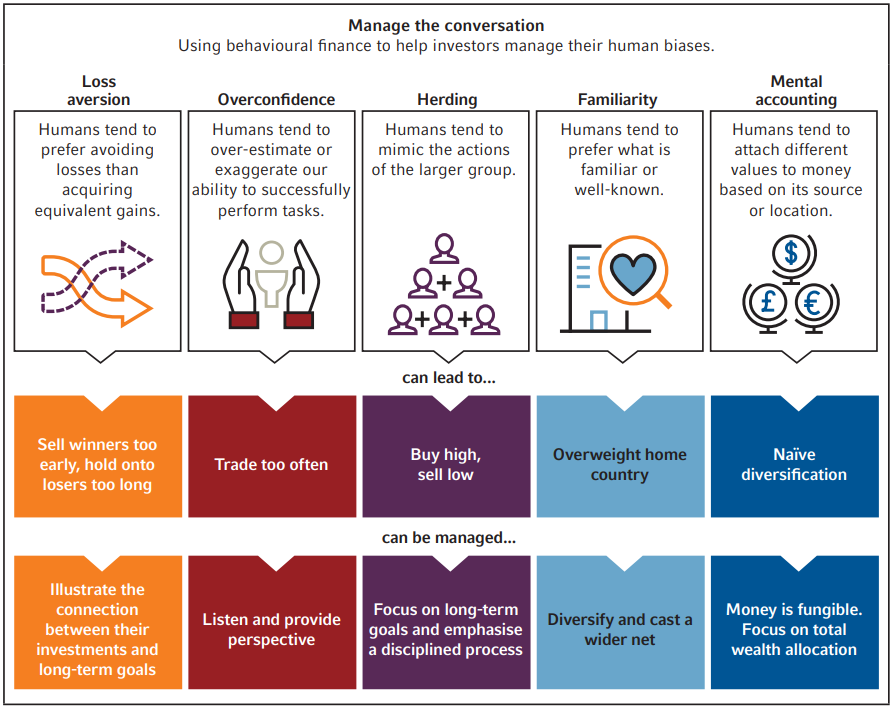

Behaviour coaching is one of the most vital parts of the service an adviser provides. While there is strong evidence that portfolio value increases over time, investors can still feel compelled to react to short-term market volatility, which can undermine their long-term objectives.

The study of investor behaviour shows us many investors buy high and sell low. A trusted adviser, however, can guide investors to avoid these behavioural mistakes.

We think that this adds as much as 1.9% p.a. of additional return to an investor’s portfolio.

Investors look for patterns in the stock market

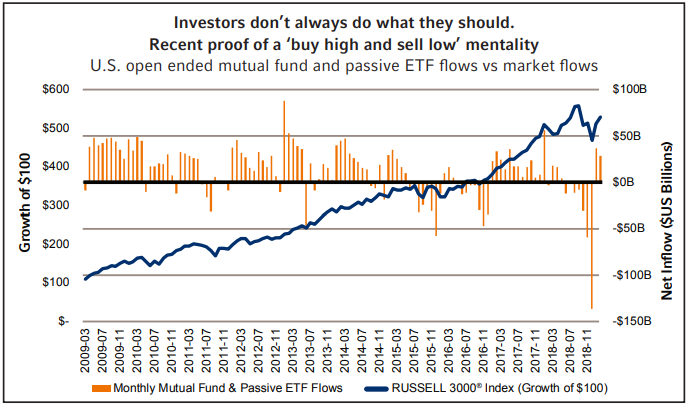

Based on our own US study analysis, the average equity investor’s inclination to chase past performance would have underperformed the Russell 3000® Index.

From December 2007 to December 2018, investors withdrew more money from U.S. stock mutual funds than they put in. All the while, $100 constantly invested in the Russell 3000® Index more than doubled in value. And those that chose to stay in cash during that period missed a cumulative return of more than 200%, based on the Russell 3000® Index.

Data shown is historical and not an indicator of future results.

Sources: Monthly mutual fund, passive ETF flows and Russell 3000® Index, Morningstar, Direct. Data as of 28 February, 2019. Index performance is not indicative of the performance of any specific investment. Indexes are not managed and may not be invested in directly.

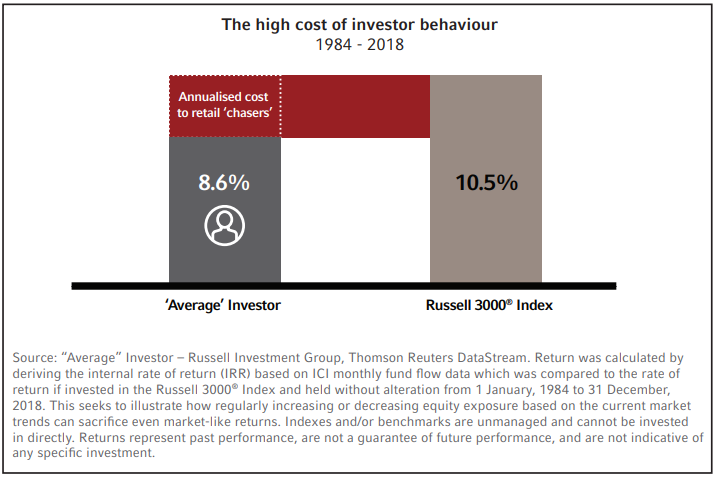

No one likes to consider themselves an average investor. But statistically, the average stockfund investor’s inclination to chase past performance cost them 1.9% annually in the 34- year period from 1984–2018. By working with an adviser, investors can become significantly greater than average. We believe an adviser’s ability to help clients stick to their long-term financial plan and skirt irrational, emotional decisions adds this value.

What drives investors to select one response over another?

Whether an investor is more inclined to hold their nerve or panic sell in times of market volatility depends on a number of factors. These include their investment objectives, including their risk tolerance and return target, and their beliefs about where they are in the market cycle and what markets will do next.

These factors (which are all invisible to the market) can sometimes lead them to come to contrasting conclusions, resulting in different investor behavior and sometimes opposing investment strategies (the only things visible to the market).

We believe advisers can play a critical role in helping investors avoid common behavioural tendencies and may potentially help their clients achieve better portfolio returns than those investors making decisions without professional guidance.

Investing without professional advice is often viewed as an effective way to lower the costs of investing, but there are also many things that can go wrong. The investor may not set the right investment strategy for their needs, they may lack the skills or time to filter through the many investment options available or they may be tempted to chase performance and over-react to market events

Research from Deloitte shows that investors often experience a disconnect between their risk profiles and their return expectations. The study into the attitudes and habits of ASX investors found younger investors were, surprisingly, more risk-averse than their older counterparts. Some 81% of investors under 35 said they were seeking guaranteed or stable returns, compared to 41% of those aged over 55. In addition, 21% of the most riskaverse investors expected returns over 10%.

Therefore the role of an adviser in helping clients to determine the best possible investment strategy and risk profile to meet their objectives cannot be overstated. Whether the client’s goal is to achieve long-term growth or preserve capital, this cannot be achieved without the right investment strategy and approach to risk.

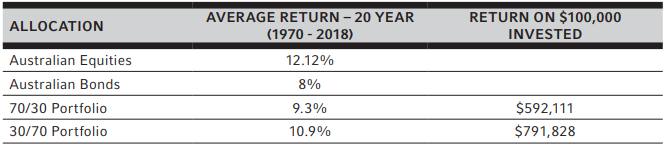

In the below example, we look at average returns of Australian equity and bond portfolios over a 20-year period. If an investor held 70% of their portfolio in growth assets and 30% in defensive, their average annual return would be 10.9% over the 20-year period. If, however, they held just 30% growth assets and 70% defensive, they would achieve annualised returns of 9.3%.

In this case, if a younger investor had invested conservatively instead of in the growth option, they would have missed out on an average of 1.6% return every year for 20 years. On $100,000 invested, that’s a significant difference of almost $200,000 to the final return.

Source: Russell Investments, S&P/ASX 300 TR, Bloomberg AusBond Composite 0+ Year Index AUD from 2003, UBS Warburg Aust Composite Bond Index prior to 2003, Commonwealth Bank All Series All Maturities prior to 1990.

In addition to investment strategy, professional advisers also bring the necessary skills to construct well-diversified portfolios, which is one of the most important contributors to long-term returns.

Advisers also provide important access to funds and strategies a client may not be aware of or able to access themselves. These include the right active strategies to build growth, complemented with passive strategies to keep portfolio costs in check, all while ensuring market timing and opportunities are not being missed.

Of course, portfolio construction and implementation are just part of an adviser’s value-add. Advisers continue to monitor the strategy set for their client and ensure all aspects of their personal finances are considered, helping the client to stay on track to achieving their financial goals.

What is clear from our analysis is that financial advisers have the potential to add significant additional value to an investor’s portfolio over the long term by helping clients to work through their values, preferences and motivations from the outset. For investors who elect to proceed without advice, there can be a big price to pay for getting a decision wrong.

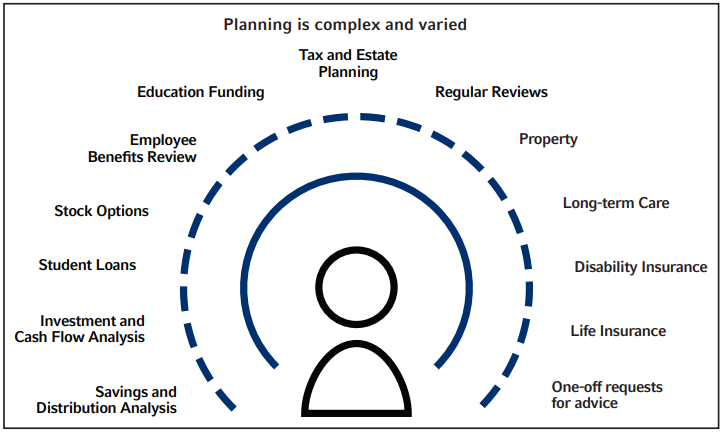

A common misconception is that financial advisers are purely investment managers, whose only job is to select investments and achieve a certain level of return. Good financial advice, however, goes way beyond this.

Advisers build and regularly update custom financial plans, conduct regular portfolio reviews, and also offer ancillary services such as tax and estate planning, investment and cashflow analysis, retirement income planning, assistance with annual tax return preparation and one-off custom requests from clients.

The quantification of the value of planning is variable depending on the adviser’s practice and services offered.

Are your clients aware of your value? Don’t minimise it or give it away!

Delivering true wealth management begins with a deep discovery conversation. It is then followed by translating what is heard into goals, circumstances and preferences. The framework is wrapped in a cycle of continuous communication.

Let’s take a closer look at the value of ancillary services an adviser and their staff offer. Advice businesses often underestimate the value of these services—insurance needs, custom requests and questions—which can quickly consume 20, 50 or 100 hours each year.

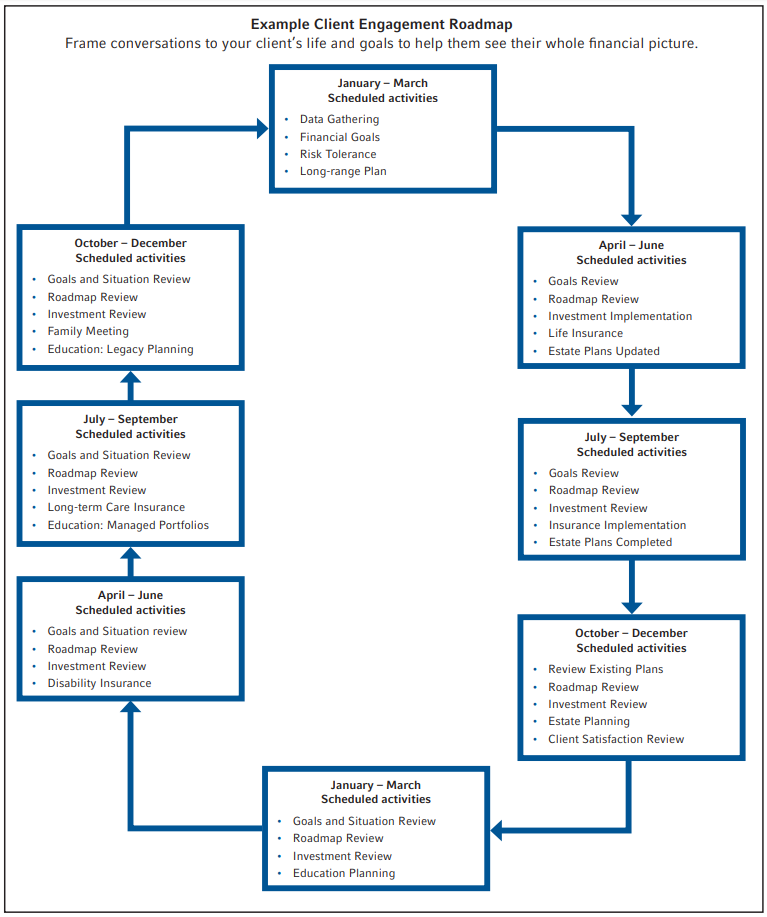

Map your commitment and engagement to clients

One of the biggest challenges an adviser faces is to help clients stay focused and on course. A solution to this problem is to provide them with a Client Engagement Roadmap, which positions the adviser as the co-ordinator of their client’s multi-faceted financial affairs. This also provides an opportunity to help the client articulate and document their goals and objectives.

The Client Engagement Roadmap then becomes the adviser’s client communication plan. It can help to position materials and information, to provide a consistent value-add experience and to highlight the benefits of additional services.

For example, tax-smart advisers can add value for their clients by:

• keeping a close eye on tax returns to consider possible savings in the future

• taking the time to stay up to date on relevant tax changes that may impact financial circumstances

• considering investment solutions that actively implement tax-efficient strategies, such as lower turnover styles, tax-minimisation overlays and centralised portfolio management

• tax advice through superannuation contribution strategies (salary sacrifice and transition to retirement) and reinvesting tax savings

• optimising tax for non-superannuation assets and managing ‘tax surprises’ as regulatory changes occur, and

• working alongside tax and legal advisers to help clients meet their financial goals.

Good financial advisers not only have the technical expertise to help clients make the most of their tax circumstances, but can also help clients to avoid any unexpected surprises at tax time.

We believe that the value of an adviser for tax-smart investing is at least the sum of:

• tax effective investment strategies

• salary sacrifice pre- and post- superannuation contributions (depending on account balances)

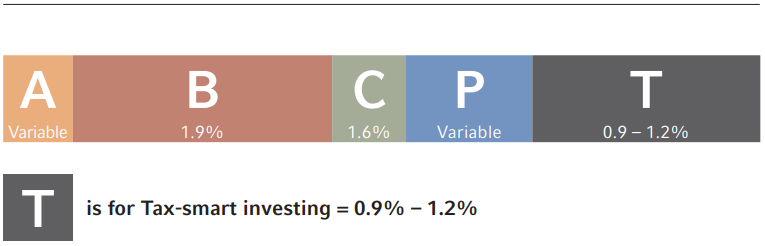

Taking the above considerations, we estimate this to be between 0.9%-1.2%p.a., depending on whether the client is in an accumulation or transition to retirement phase, based on average balances.

The bottom line

The value of an adviser is meant to quantify the contribution that the technical and emotional guidance a trusted human adviser, delivering services and value above and beyond investment-only advice, can potentially offer.

4.4% or more

This value is a meaningful differentiator in a time of regulatory scrutiny and the challenging market environment.

Remember, an adviser’s clients are their most persuasive advocates, so helping them to understand the value you deliver is essential. This formula offers a memorable and repeatable framework for advisers to have that conversation with confidence:

Let’s rise to the call of providing value to investors.

At Russell Investments, we believe in the importance of advisers. We see the advantages you create for your clients. We know the commitment you bring to your relationships. This annual report quantifies that dedication and the resulting benefit. It is one small part of our work in powering adviser success.